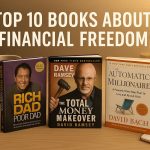

Financial freedom means the ability to live on your terms without money dictating your choices. Achieving it requires more than just saving-it demands critical mindset shifts, strategic investing, disciplined budgeting, and long‑term planning. This list of Top 10 Books About Financial Freedom blends New York Times and Amazon bestsellers with enduring personal finance classics, covering everything from debt elimination to passive income generation. Each book’s abstract distills its most actionable insights into a clear framework for change. Whether you’re just starting your financial journey or fine-tuning strategies toward early retirement, these works provide the inspiration, knowledge, and tools to create lasting financial independence.

Top 10 Books About Financial Freedom

1. Rich Dad Poor Dad by Robert T. Kiyosaki

Kiyosaki contrasts the financial philosophies of his “rich dad” and “poor dad,” revealing how mindset determines wealth-building potential. He dismantles conventional wisdom-like relying solely on a high-paying job-by emphasizing asset creation, financial literacy, and entrepreneurial thinking. Through personal stories, he explains how to identify opportunities, leverage money effectively, and make investments work for you. The book empowers readers to shift from employee to investor mindset, focusing on passive income streams and reducing dependency on earned income. It’s a foundational work that has redefined how millions think about money, assets, and the lifetime pursuit of financial independence.

+ Book Summary of Rich Dad Poor Dad by Robert T. Kiyosaki

2. The Total Money Makeover by Dave Ramsey

Ramsey delivers a proven step-by-step plan to get out of debt, save for emergencies, and build wealth. Centered around his “Baby Steps” approach, the book helps readers gain control over spending, eliminate credit card dependency, and save with discipline. He promotes a debt-free lifestyle, using real-life stories to show the plan’s transformative impact. Beyond numbers, Ramsey addresses the emotional and behavioral aspects of money, showing how habits shape financial futures. The focus is on avoiding quick fixes and sticking to steady, sustainable progress. By tackling debt first, readers create momentum toward long-term security, freedom, and stress-free financial living.

3. Your Money or Your Life by Vicki Robin & Joe Dominguez

Robin and Dominguez reframe money as life energy, urging readers to align spending with personal values. Their nine-step program covers tracking expenses, reducing waste, and achieving “enough” instead of chasing endless consumption. By distinguishing needs from wants, they pave a path to lower stress and greater satisfaction. The book teaches that true wealth is measured by time and freedom, not possessions. A practical yet philosophical guide, it inspires conscious financial choices and sustainable living. Its message resonates strongly for those seeking financial independence through mindfulness, frugality, and purpose-turning money management into a gateway to intentional, liberated lifestyles.

4. The Millionaire Next Door by Thomas J. Stanley & William D. Danko

Based on extensive research, this book reveals that many millionaires are not flashy spenders but disciplined savers. Stanley and Danko show how ordinary people achieve extraordinary wealth by living below their means, avoiding unnecessary debt, and investing wisely. The seven key traits they identify-including frugality, self-sufficiency, and long-term planning-demonstrate that financial freedom is accessible to anyone willing to manage their money intentionally. By showcasing real-life profiles, they debunk myths about wealth, emphasizing that most millionaires build their fortunes slowly over decades. The core lesson: sustainable wealth comes from consistent, intelligent decisions, not luck or windfalls.

5. Think and Grow Rich by Napoleon Hill

A timeless personal development classic, Hill distills lessons from 25 years of studying successful individuals, including Andrew Carnegie, Henry Ford, and Thomas Edison. While the focus is on mindset, the book also delivers practical principles such as goal setting, persistence, and specialized knowledge. Hill’s “13 principles of achievement” form a blueprint for turning desire into wealth. Emphasizing belief, visualization, and action, it bridges the gap between thought and reality. Though written during the Great Depression, its core ideas about determination, positive thinking, and strategic action remain powerful tools for anyone striving for financial independence and personal fulfillment.

+ Review of Book Think and Grow Rich by Napoleon Hill

6. The Automatic Millionaire by David Bach

Bach’s philosophy revolves around paying yourself first through automated saving and investing. He introduces the simple yet powerful idea of making wealth-building effortless by removing reliance on willpower. The “Latte Factor” metaphor illustrates how small daily expenses can add up to significant investments over decades. Bach guides readers on setting up automatic payments for retirement, emergency funds, and debt reduction. The focus is on creating a financial system that runs itself, freeing mental energy for life’s priorities. This approach empowers readers to achieve millionaire status without budgeting obsession-just consistent, automated action toward clear, long-term goals.

7. I Will Teach You to Be Rich by Ramit Sethi

Sethi targets millennials with a practical, no-guilt personal finance system covering credit cards, student loans, savings, and investing. His focus is on “conscious spending” rather than extreme frugality, encouraging readers to enjoy life while still building wealth. The six-week program guides readers through system setup, from automating payments to negotiating better deals. Sethi pushes index investing and passive management while showing how to optimize earnings potential. His direct, humorous style makes complex topics approachable, especially for beginners. The overall goal: create a rich life defined by personal satisfaction and choice, not just a large bank balance or retirement fund.

8. Financial Freedom by Grant Sabatier

Sabatier shares his journey from having $2.26 in his bank account to financial independence in five years. Focused on maximizing income, saving aggressively, and investing strategically, the book challenges traditional retirement timelines. Sabatier introduces concepts like “time hacking” and “arbitrage” to accelerate wealth-building. He emphasizes building multiple income streams-from side hustles to real estate-and reinvesting profits. His framework prioritizes flexibility and self-defined success over rigid goals. With clear mathematics, motivating personal stories, and actionable steps, Sabatier proves financial freedom can be achieved much earlier than traditional thinking suggests, provided one commits to focused, consistent, and substantial money decisions.

9. The Simple Path to Wealth by JL Collins

Originally written as guidance for his daughter, Collins’ book offers a straightforward investing roadmap. He advocates low-cost index funds, minimal debt, and a frugal lifestyle as the surest route to financial independence. Collins explains the stock market in plain language, demystifying risk, compounding, and asset allocation. His guiding philosophy-avoid complexity, keep costs low, and stay the course-has made the book a modern classic in the FIRE (Financial Independence, Retire Early) community. Beyond technical advice, he emphasizes the freedom and security sound investing provides, making this an invaluable resource for anyone seeking sustainable, hands-off wealth building for life.

10. The Richest Man in Babylon by George S. Clason

Using parables set in ancient Babylon, Clason delivers enduring lessons on money management: save at least 10% of income, control expenses, and make money work for you. The storytelling format makes financial principles memorable and relatable, illustrating that discipline and wise investments lead to wealth regardless of era. These foundational rules-guarding against loss, seeking expert counsel, and building passive income-remain relevant for modern readers. Its simplicity and focus on timeless truths make it an ideal starting point for anyone aiming to master personal finance fundamentals and lay the groundwork for lasting financial security and independence.

+ Book Summary of The Richest Man In Babylon by George Samuel Clason

Conclusion: Top 10 Books About Financial Freedom

These Top 10 Books About Financial Freedom uniting New York Times bestsellers, Amazon bestsellers, and time-tested classics-offer a complete education in achieving financial freedom. From mindset transformation to step-by-step debt elimination, from investing strategies to automation systems, they equip readers with the tools to control money instead of being controlled by it. Whether your path involves entrepreneurial ventures, early retirement, or simply living without financial stress, these works provide the clarity and motivation needed to make it a reality. Financial freedom begins with knowledge, and each of these books offers the perspectives and strategies to turn informed intent into lasting independence.